CBD – Can’t Mail It Because it’s Kind of Not Legal

CBD seems to be everywhere, from all over the news to local pet stores. Given its proliferation, it is easy to assume that CBD, particularly CBD derived from industrial hemp, is completely legal under state and federal law. But, it is not. According to the DEA, CBD remains a Schedule I Controlled Substance and mailing […]

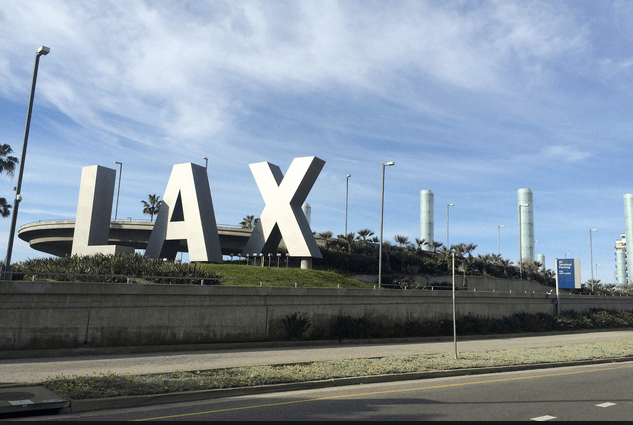

Higher Than Ever Before

Written by Taylor Ulrich, J.D. Los Angeles International Airport recently published the current position of the Los Angeles Airport Police Department by updating its public cannabis policy on its website stating that the department “will allow passengers to travel through LAX with up to 28.5 grams of cannabis and 8 grams of concentrated cannabis”. While […]

Crackdowns in California: Scare Tactic or Simply Scary?

The Bureau of Cannabis Control (BCC) is cracking down heavily on illegal businesses, or so it wants you to think. As California entered its ninth month of operating in the regulated cannabis market, the BCC widely announced two enforcement actions on unlicensed businesses in the state, one against a Costa Mesa dispensary and the other […]

California to Eliminate Cash Bail System

Written by Elizabeth Kozlov On August 28, 2018, California Governor Jerry Brown signed a piece of trailblazing legislation that is set to revamp California’s cash bail system. Senate Bill No. 10, also known as the California Money Bail Reform Act, is set to go into effect on October 1, 2019. The new law passed in […]

Choosing the Best Entity for your Cannabis Company (Not just Corp vs. LLC)

Written by Abraham Finberg, CPA and Simon Menkes, CPA Traditionally, deciding on the best entity for a business involves a comparison of the Corporation versus the LLC, with a few nods to Partnerships and Sole Proprietorships thrown in. However, if you decide to go into the cannabis business, choosing a corporation is a bit more complicated […]

Paying Federal Income Tax – the Deductions Cannabis Businesses Can’t Take

The two definites in life are death and taxes – even for cannabis businesses. As you may well know, when it comes to taxes, cannabis businesses don’t have it easy. Enter tax code 280E. 26 U.S.C. §280E allows the Internal Revenue Service (“IRS”) to deny general business tax deductions – essentially prohibiting any “deduction or […]

Phase 2: Only a few days left!

Written by Elizabeth Kozlov On August 1, 2018, the Los Angeles Department of Cannabis Regulation (“DCR”) began accepting applications for Phase 2 priority processing for select cannabis businesses that were involved in non-retail cannabis activity prior to 2016. This is the second application window the DCR has opened for LA City-level licensing since state legalization. The […]

CBD – Is Corporate America Playing with Fire

Written by Taylor Ulrich, J.D. For many years, California has been the “cool kid” when it comes to cannabis regulation. In fact, California pioneered the legalization of cannabis for medical use in 1996. But until this year the state’s cannabis industry has been largely unregulated. At the start of this year, California joined the small […]

Cannabis Recalls: Cause for Panic or Just Good Corporate Citizenship

Last month, two California cannabis companies, Lowell Herb Co. and Bloom Brand, voluntarily recalled products, making retailers pull the affected products off the shelf. Are such recalls about to become common, or is this an isolated event? The Recalls The Bloom Brand recalled four products sold in early July for containing myclobutanil, aka Eagle 20 […]

Controversial Proposals in California’s Final Regs Countdown

They’re here. Proposed regulations from California’s three cannabis licensing authorities were released last month, kicking off the long-awaited regular rulemaking process. These proposed regulations will be here to stay for the foreseeable future once adopted by the state, giving the cannabis industry some much-needed respite from the regulatory whirlwind of the past year. Since the […]